By Ts. Elbegsaikhan

From the outset, Mongolia's 2025 state budget has drawn criticism. Now, just six months later, the government has been forced to face economic reality. Under the leadership of the new administration - and particularly at the initiative of the Prime Minister - a decision has been made to revise the budget, signaling a possible shift in broader macroeconomic policy.

The urgent need for this budget adjustment stems from one clear reason: a sharp drop in coal export revenues. In just the first half of the year, revenue fell short by 3.3 trillion MNT, making a revision unavoidable. Coal - an export commodity with relatively low added value - has seen a drop in demand in the Chinese market, and sluggish supply has further disrupted the composition of Mongolia's fiscal revenues and spending. As a result, numerous projects and programs have been suspended, and many government employees are now facing layoffs.

MAIN CHANGES IN THE AMENDED BUDGET

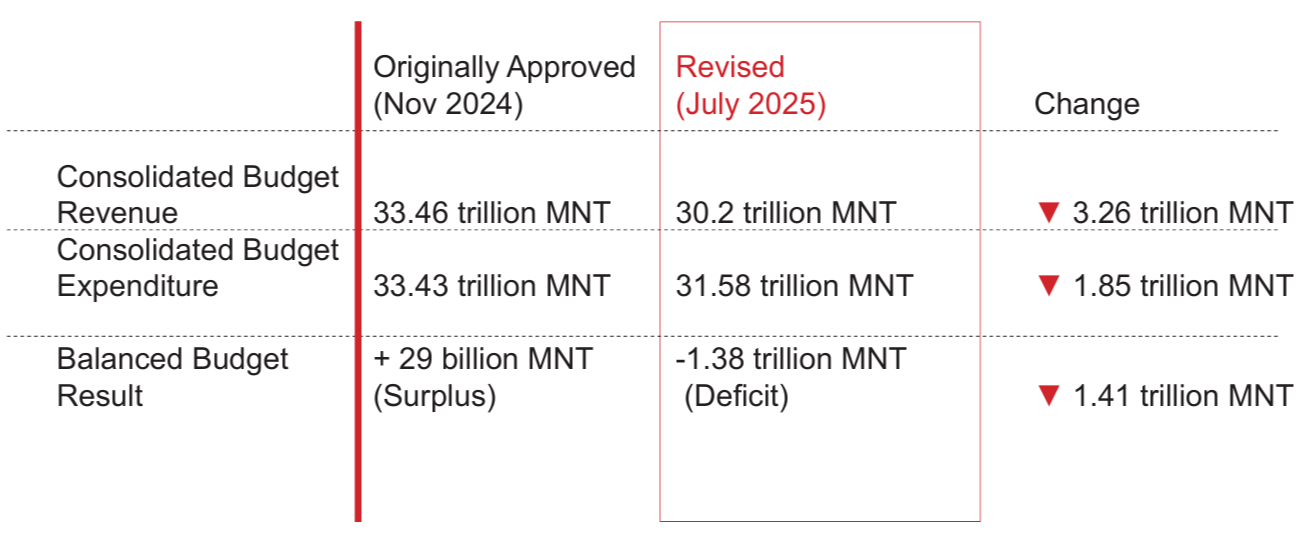

Following Parliament's approval of the budget revision, several key changes were introduced:

Over 500 billion MNT of this cut came from capital expenditures - specifically from projects and activities that had not signed contracts with contractors by May 31, 2025, in line with the State Austerity Law. These are essentially projects that will not move forward this year. According to the Ministry of Finance, this measure aims to improve accountability among budget managers and end the practice of allocating funds to unprepared or unvetted projects.

However, this decision has drawn criticism due to the government's failure to publicly disclose a detailed list of affected projects. As a result, numerous infrastructure initiatives - the construction of kindergartens, schools, hospitals, and roads in rural areas - have been postponed indefinitely.

In addition, 1.3 trillion MNT was cut from current expenditures, requiring government institutions to implement significant operational savings. Approximately half of these savings will be achieved through reductions in the public sector workforce. As part of efforts to eliminate redundancy and streamline government operations, 14,400 civil servant positions are set to be cut.

The government, which recently organized the Mongolia Economic Forum, estimates that it will save 617.3 billion MNT by trimming programs and activities across all levels of the public sector, 76.8 billion MNT by reducing institutional subsidies, and 30.2 billion MNT through cuts to bonuses and allowances.

In effect, the government is sending a strong message to curb official travel, fuel usage, office supply purchases, and other discretionary spending.

However, some expenditures remain untouched - or have even increased. For instance, subsidies on loan interest provided through programs such as the Food Revolution and New Cooperatives have not been reduced. Hundreds of billions of MNT remain allocated under the portfolio of the Minister of Food, Agriculture, and Light Industry for these subsidies.

At the same time, the government has refrained from reducing social welfare spending, which economists consistently flag as a growing concern. Key expenditures - such as pensions, benefits, and child allowances - have been left intact, raising the risk that Mongolia will remain heavily dependent on welfare support.

THE BUDGET SHOULD BE DIRECTED TOWARDS SUPPORTING ECONOMIC GROWTH

Due to the decline in global coal prices, Mongolia's budget revenues fell short by 3.3 trillion MNT in the first half of the year. With a significant revenue shortfall expected in the second half as well, the government has revised the budget to cut expenditures by 1.8 trillion MNT, with the remaining gap to be financed through borrowing. This indicates a lack of serious concern about revenue collection in the remaining months.

According to the budget revision, the government aims to "increase revenue by expanding the tax base, improving tax collection, and enhancing the efficiency of state-owned enterprises" to offset the shortfall. However, the drop in coal prices is placing greater pressure on the real economy than on the budget itself. The reduced income of coal exporters is disrupting their supply chains and decreasing foreign currency inflows - posing a risk of exchange rate pressure that could impact businesses and households alike. In fact, that pressure is already being felt.

In this context, expanding the tax base will be a major challenge. With few willing or able to take on that obligation, it is likely that tax officers will be left to shoulder most of the burden.

Finance Minister B. Javkhlan has called this a "budget of austerity," emphasizing its focus on cutting wasteful spending and strengthening fiscal discipline. However, the core issue remains: even after the revision, the budget continues to reflect overspending. Because the decision to save 1.85 trillion MNT does not appear to be a budget amendment, but rather a decision made in accordance with the State Austerity Law.

Finance Minister B. Javkhlan has called this an "austerity adjustment," highlighting efforts to cut wasteful expenditures and strengthen fiscal discipline. However, the underlying issue remains: even after the revision, the budget still reflects overspending.

Another major concern is the rapidly expanding and increasingly bloated budget year after year. As Minister Javkhlan himself noted, this "wasteful" budgeting has placed unprecedented pressure on the exchange rate of the Mongolian currency. In its June 2025 review, the International Monetary Fund (IMF) acknowledged improvements in Mongolia's macroeconomic conditions but warned that expansionary fiscal policies are intensifying inflationary pressures. "The sharp increase in public expenditures during 2023-2024 - particularly on wages and capital investments - is linked to expansionary policies, which have driven rapid credit growth, rising inflation, and increased imports," the IMF stated.

Beyond fueling inflation, the rising exchange rate and foreign currency outflows have constrained the scope for monetary easing, making it increasingly difficult for the real (private) sector to access financing and loans. This issue was strongly criticized by B. Lkhagvajav, President of the Mongolian National Chamber of Commerce and Industry (MNCCI). He remarked, "Yes, a budget revision is necessary under the current conditions. But cutting 1.8 trillion MNT is not enough - tax revenues simply will not accumulate as expected. We need to cut 10 trillion MNT from spending. That is not just an abstract number. If we calculate coal export revenues using the current actual price - around $70 per ton - it becomes clear what the real revenue figure should be."

A national budget should be designed to support economic growth. A budget revision, by its nature, should correct earlier mistakes. But as it stands, the 2025 budget revision may be steering the country toward an even greater mistake.