The Mongolian Mining Journal - December, 2025

By B. Tugsbilegt

As Oyu Tolgoi, one of the world's largest copper mines with the potential to rank among the top three globally, approaches peak production, the government is entering negotiations with Rio Tinto. Under their existing agreement, negotiations are stipulated every seven years, and this round of negotiations is particularly important. It aims not only to enhance Mongolia's returns from Oyu Tolgoi but also to resolve issues related to Entrée Resources.

The government is still learning the "art of negotiation," encouraged by its successful agreement with the French state-owned company Orano that was based on specific returns. So it enters talks with Rio Tinto with considerable confidence and optimism, while the public eagerly awaits the outcome. At the same time, it is clear that Rio Tinto, benefiting from rising market prices, is taking a relatively favorable and flexible approach. In this sense, the timing of the negotiations works in our favor. Nevertheless, it is still too early to celebrate.

In addition to clarifying the actual situation at Oyu Tolgoi, a key factor prompting the government's entry into negotiations was the open hearings on Oyu Tolgoi organized by the Parliamentary Interim Oversight Committee.

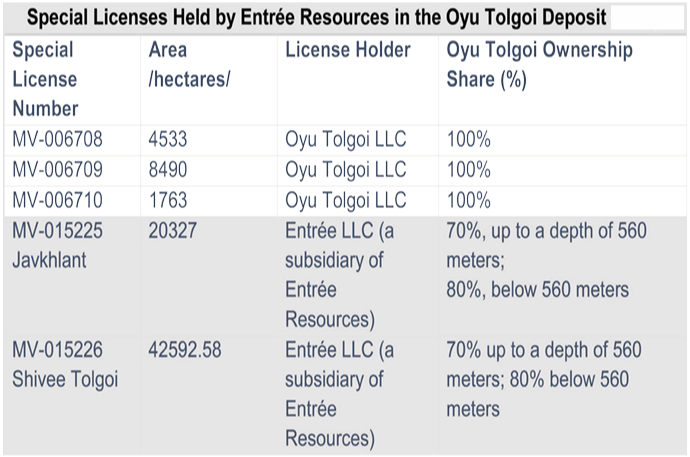

The three-day hearings, held on December 8-12, analyzed and shared information on issues related to Oyu Tolgoi's benefits, including the Shareholders' Agreement, the Dubai Agreement, and the reserves of the Javkhlant (MV-15225) and Shivee Tolgoi (MV-15226) exploitation licenses held by Entrée Resources. The hearings also examined matters related to determining the state's ownership share in these licenses.

The hearings were highly effective and engaging, incorporating expert assessments as well as participation from government representatives and officials from Oyu Tolgoi LLC and Entrée Resources. As a result, Parliament issued a resolution outlining five main directions: ensuring that Mongolia's share of benefits remains no less than 53%, resolving Entrée-related issues once and for all, reducing the interest rate on project financing, conducting reserve studies to increase the value of the deposit, and routing financial transactions through domestic banks.

Specifically, the provisions of the parliamentary resolution, developed and approved by the Interim Oversight Committee on Oyu Tolgoi, cover the following functions:

1) Review the decisions and operational legal framework related to the Javkhlant and Shivee Tolgoi mining licenses held by Entrée Resources and verify their compliance with the law.

If necessary, take measures up to and including revocation of the licenses, and prepare a proposal to determine the state's ownership share in a manner that ensures the majority of benefits accrue to the people. Establish conditions to ensure that Mongolia will not bear any obligations or responsibilities related to financing or investments that could negatively affect the country's future benefits.

2) Conduct a joint review of the implementation of the Agreement, concluded on June 8. 2011, between Erdenes MGL LLC, Ivanhoe Mines Oyu Tolgoi (BVI) Ltd., Oyu Tolgoi Netherlands B.V., and Oyu Tolgoi LLC, as amended and restated.

Assess the cost of lost opportunities, draw conclusions, propose amendments in accordance with the Constitution of Mongolia and other applicable laws, align related agreements and legal documents, and realistically reduce the interest rates on financing for both shareholders and third parties.

3) Continue geological and exploration studies of the Oyu Tolgoi deposit, enhance the value of the deposit, and strengthen monitoring and oversight.

4) Ensure that Mongolia's share of benefits, based on the initial estimates, remains no less than 53%, and include this condition in the relevant agreements

Review this share every three years and report the benefits accruing to each party separately in Oyu Tolgoi LLC's annual operational report.

5) Ensure that the export sales revenue of Oyu Tolgoi LLC is fully processed through the Bank of Mongolia and domestic commercial banks.

REACHING A UNIFIED UNDERSTANDING BETWEEN THE PARTIES IS EXTREMELY IMPORTANT

The Oyu Tolgoi project is, in many respects, truly remarkable. From the outset, Rio Tinto has consistently identified Oyu Tolgoi as its project with the greatest growth potential. For Rio, which derives the majority of its revenue from the iron ore sector, there is a strategic ambition to expand further into critical minerals such as copper and lithium. The company owns several copper mines at various stages of operation and development in multiple countries.

Starting in 2030, Rio aims to produce 1 million tons of copper annually, and the share of copper in the company's total sales revenue is steadily increasing. To strengthen its strategic focus on copper, Rio Tinto fully acquired Turquoise Hill Resources in 2022.

For Mongolia, Oyu Tolgoi is not only a key driver of the economy but also an important factor in shaping a positive international perception of the country. Therefore, Oyu Tolgoi is undoubtedly a crucial and strategically significant project for both parties.

The construction phase of this mine, which combines both open-pit and underground operations, is complete, and the project is now transitioning into a new phase of production. The next critical milestone is to recover the investment costs and begin generating profits. The era of discussing large investment inflows is over; the focus has now shifted to achieving significant sales revenues.

At this stage, both parties must reach a mutual understanding regarding both benefits and resource utilization. The open hearings revealed a clear discrepancy between the documents presented by the two sides. The Mongolian side reported that Mongolia's share of the project's benefits stands at just 37%. In contrast, Oyu Tolgoi LLC indicated that the majority of the project's total cash flow is expected to accrue to Mongolia, projecting that the country will receive 61% of the project's benefits, totaling $57.5 billion over the life of the project.

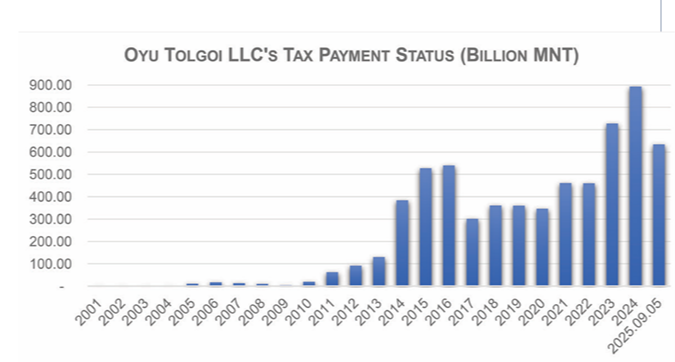

The Investment Agreement for the Oyu Tolgoi project was signed in 2009, and the open-pit mine was rapidly brought into operation, with the first concentrate transported in 2013 - relatively recently. Since the start of concentrate exports, a full 12-year cycle has passed. Oyu Tolgoi LLC reported that, over this period, it has paid a total of 13.7 trillion MNT ($5.3 billion) in taxes, fees, and duties to the Mongolian government.

However, it is important to note that mining will continue at the Oyut deposit, Hugo North, and the Hugo North Extension until 2051, after which the currently planned operations are expected to cease. This leaves just two full 12-year cycles remaining. The peak of production is expected over the next 10 years. Experts continue to warn that during the peak production period, as the project focuses on recovering its construction costs, Mongolia's last hope of receiving dividends may be lost.

The tax information is somewhat contradictory. Naturally, greater trust is placed in the data provided by the General Department of Taxation of Mongolia. During the hearings, detailed information on tax payments, which drew significant attention, was presented by S. Tugsjargal, head of the Large Taxpayer Office at the General Department of Taxation.

As of September 5 of this year, the company has paid a total of 6.4 trillion MNT in taxes, fees, and levies since 2002, covering 18 different types of taxes, fees, and payments. Oyu Tolgoi LLC's tax assessments and payment status have been subject to six audits conducted by the General Department of Taxation (GDT). As a result, the company paid a total of 1.3 trillion MNT in 2021 and 2024 to settle the disputed taxes. According to the GDT, since 2002 and as of the third quarter of 2025, Oyu Tolgoi LLC has incurred total expenditures of 62.9 trillion MNT.

The tax dispute between the Government of Mongolia and Rio Tinto is currently ongoing at the London arbitration court. Should Mongolia prevail, it could lead to Oyu Tolgoi LLC beginning profit tax payments earlier than previously scheduled.

Over the past 16 years, Oyu Tolgoi LLC has extracted and processed a total of 440 million tons of ore, producing 8.4 million tons of copper concentrate, which were sold for USD 16.3 billion. During this period, the company has contributed $3.2 billion in taxes, royalties, and fees to Mongolia's national budget, according to an expert presentation at the open hearings.

During the hearings, various aspects of Oyu Tolgoi LLC's tax payments were discussed, though the figures presented did not always meet expectations. Some members of Parliament expressed strong dissatisfaction with the company's tax contributions, while others asked, 'Will the expansion of the underground mine and the increase in production result in over a billion dollars in taxes and fees collected annually?" It is not unreasonable to ask this question, yet it is rare to find ministers or officials who can respond simply with 'Yes, of course. Clearly, expectations and reality remain far apart.

OYU TOLGOI LLC NEEDS TO MAKE ITS FINANCIAL REPORTS PUBLICLY AVAILABLE

Currently, within the Erdenes Mongol group, a unified financial model for Oyu Tolgoi's returns has been developed. Rio Tinto also has its own such model. Efforts are now underway to align these two models. As a result, the question of ensuring that Mongolia receives no less than 53% of the returns should become much clearer. Going forward, Oyu Tolgoi LLC needs to disclose not only its operational reports but also its financial reports to the public. This transparency will provide a clear picture of the actual financial pressures the company is facing and allow for an assessment of whether it is genuinely able to reduce its financial burden.

In 2022, the write-off of a $2.3 billion debt on the government's 34% stake in Oyu Tolgoi was a major event. At the time, it was reported that this move not only saved the country from the risk of missing out on dividends by 2051 but also prevented the potential danger of falling into a $22 billion debt. We heard the wonderful news that the government was now debt-free.

However, the critical issue of reducing the financial burden on Oyu Tolgoi LLC was largely overlooked. The underlying logic is clear: only by improving the company's financial position can greater returns be delivered to the shareholders. Accordingly, the financial burden on Oyu Tolgoi must now be gradually alleviated.

For example, it may be possible to reduce financing interest by 3% or more. Additionally, it is crucial to immediately revise the methodology for calculating loan interest, particularly with respect to interest compounded quarterly. Another important measure would be to exclude the additional costs arising from interest compounding from the project's total expenses.

These are priority measures that should be implemented in accordance with international financial and market fairness principles. By doing so, Oyu Tolgoi LLC can advance toward profitable operations, which will lead to increased taxes, fees, and levies, as well as enable faster repayment of investment costs. Consequently, the timeline for receiving dividends can be accelerated. The government and Oyu Tolgoi LLC should regularly provide open and transparent information to the public regarding outcomes, market price fluctuations, and the returns generated. This transparency will help eliminate uncertainties surrounding the project.

This project is undoubtedly poised to be a long-term driver of Mongolia's economic growth. However, weak returns from the project would have a significant negative impact not only on Mongolia but also on Rio Tinto's reputation. From Mongolia's perspective, the issue extends beyond merely hoping for dividends; the country is also entitled to receive additional benefits from the project through Corporate Income Tax (CIT), mutually agreed-upon royalties, and other forms of returns. Currently, the benefits accruing to Mongolia are largely limited to the basic mineral royalty, as emphasized by former Deputy Minister of Justice and Home Affairs B. Solongo during the hearings.

WHETHER WE CAN SEIZE THE OPPORTUNITY DEPENDS ON US

For Oyu Tolgoi LLC, the project's debt is entirely the company's responsibility and does not directly affect Mongolia or its citizens. As with other companies operating in Mongolia, the project's financing rests solely with the company, as explained. These statements carry significant implications. From this, Mongolia is learning an important lesson about financing large-scale projects. It has become increasingly clear that associated investment costs must be carefully tracked and managed.

In 2022, Mongolia became free of debt associated with its 34% stake in Oyu Tolgoi. This allowed the country to make it clear to Rio Tinto that the substantial debt of Oyu Tolgoi is entirely unrelated to Mongolia. A positive aspect of this development is that no interest on the loan is now charged to the government. However, in other respects, the financial burden on Oyu Tolgoi, particularly the pressure from loan interest, remained unchanged and did not decrease.

Now, the time has come to address this unfinished work, and expectations are high. In other words, efforts are underway to reduce Oyu Tolgoi's investment costs as much as realistically possible; otherwise, the benefits for Mongolia will not increase.

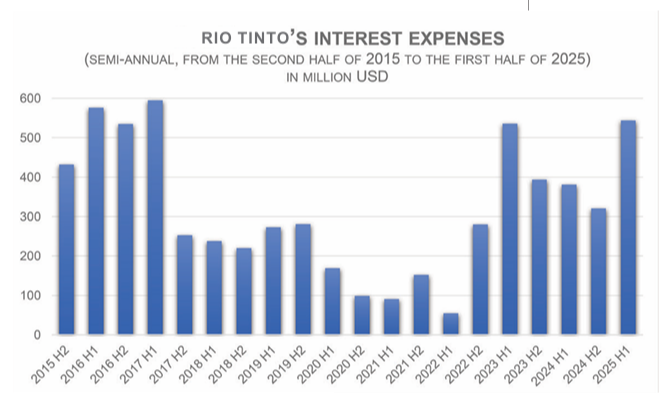

Rio Tinto fulfilled its obligation to fully finance the open-pit and underground copper project. However, in doing so, it significantly increased financing-related loan service costs and shifted much of the burden onto Oyu Tolgoi. These included loan guarantee fees, additional interest, and the practice of compounding interest. For a company like Rio Tinto, which consistently emphasizes adherence to international standards, the introduction of quarterly compounding - and the inclusion of such provisions in the Shareholders' Agreement and other related financial contracts - created conditions highly disadvantageous for Mongolia. Naturally, charging interest on interest quarterly generates substantial returns for Rio Tinto.

In a project involving such massive investment, high interest rates, and the practice of compounding interest, it undeniably reduces overall returns. However, Rio Tinto agreed with the Mongolian side to leave room for revisiting the financing loan interest, and whether this opportunity can now be effectively utilized depends entirely on us. On the other hand, the remarkable long-term rise in copper, gold, and silver prices is expected to increase Oyu Tolgoi's sales revenue, making it possible to recover costs in a shorter period.

Rio Tinto explains that the shareholders of the Oyu Tolgoi project must operate within the framework of the Investment Agreement, and while the company itself has not yet received any dividends, the Mongolian side has already begun. benefiting through taxes and fees. However, calculations show that Oyu Tolgoi is required to pay between $1.36 and $1.5 billion annually in interest alone on project financing loans. In comparison, Rio Tinto's own interest expenses at the group level amount to no more than $1 billion per year. This suggests that Rio Tinto does have the capacity to reduce the interest burden on Oyu Tolgoi's loans.

The open hearing highlighted that Oyu Tolgoi LLC may face potential risks to its ability to meet payment obligations, as reflected in its financial indicators. This situation stems not only from the fact that the copper project is financed with a massive loan but also from the high interest rates. Public perception often simplifies the Oyu Tolgoi project as a $14 billion open-pit and underground mine. However, experts at the hearing clarified that between 2010 and 2024, the project actually received a total of $21.9 billion in financing. During this period, $8.9 billion had already been paid toward the principal and interest.

As of the end of 2024, Oyu Tolgoi LLC's total outstanding loan balance amounts to $18.7 billion. Of this, $11.3 billion - including $5.2 billion in accrued interest - consists of shareholder loans. During the open hearing, it was noted that interest on these loans accrues at a rate of approximately $1.4 billion per year.

Thus, when the repayment of this loan is completed in 2037, a total of $25.1 billion is projected to be paid - $6.1 billion toward the principal and $19.1 billion in interest. This clearly shows that, unless Oyu Tolgoi LLC's financial situation is improved, it is unrealistic to expect significant benefits for Mongolia or to anticipate collecting a billion dollars annually in taxes and fees.

*“(In some studies reported internationally by Turquoise Hill, molybdenum resources are noted as 413 436 thousand tonnes, while in Entrée’s licensed areas, the estimated potential molybdenum resources are 390 thousand tonnes.)”

A NEW ACQUAINTANCE FROM OLD TIMES

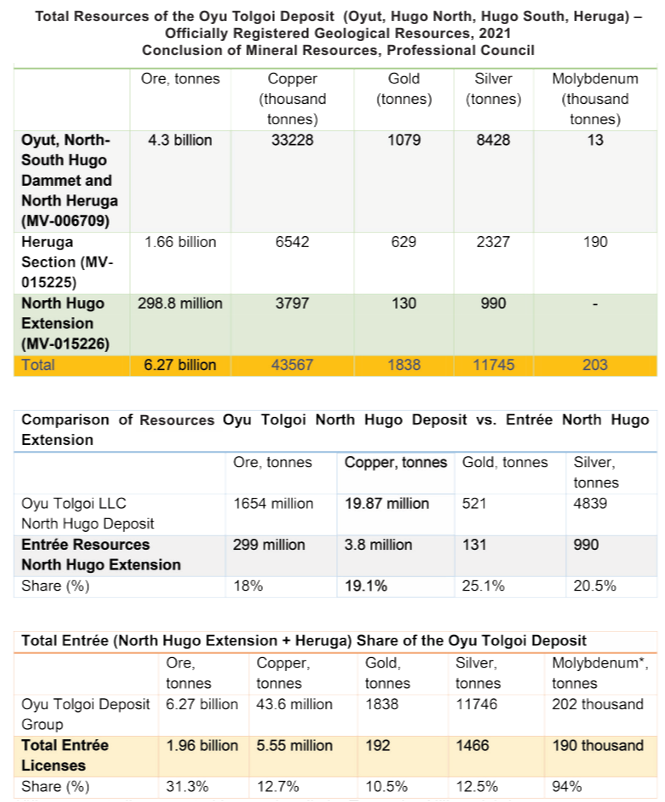

At the three-day Oyu Tolgoi hearing organized by the Interim Oversight Committee, discussions also addressed issues related to the Canadian company Entrée Resources, which holds the special licenses for the Javkhlant and Shivee Tolgoi areas within the Oyu Tolgoi deposit.

Back in 2009, when everyone was celebrating the Investment Agreement and dreaming of a massive copper mine, few paid attention to the Entrée issue. In the agreement, Entrée was merely "tucked in" under a single clause (15.7.8 of the Investment Agreement). It wasn't until 2025, after years of largely overlooking the company, that it became clear Entrée is actually a very important partner for Oyu Tolgoi, a "New Acquaintance from Old Times," so to speak. The company is larger and more of a longer-term partner than it appears, as evidenced by its mining licenses for the Hugo North Extension and Heruga deposits.

In these areas, Entrée has a profit-sharing agreement with Oyu Tolgoi LLC. Notably, the Heruga deposit - which will be developed in the future and contains a massive copper resource-also encompasses nearly the entire molybdenum reserve of the Oyu Tolgoi deposit. If the government negotiates wisely on the Entrée issue, there is a significant opportunity to secure a highly favorable outcome for Mongolia.

However, there is no time to waste. The main issue under discussion-the Hugo North Extension-is about to enter the underground mining phase, creating an urgent need to accelerate negotiations. Mongolia plans to conclude a separate new Investment Agreement with Entrée, determine the state's ownership share, and implement mineral royalty payments in a form that has not yet been finalized.

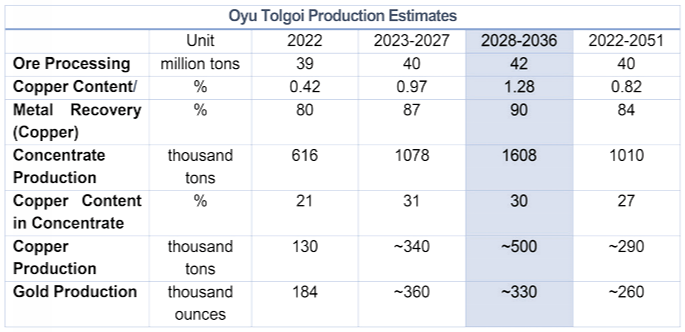

Therefore, in moving forward, it is essential to reach a clear agreement and align understanding with Rio Tinto regarding the size of the Oyu Tolgoi deposit and its development. Hearing and accepting the deposit estimates approved by our Mineral Resources Professional Council is one thing, but it is equally important to reconcile these figures with the company's projections. According to previous estimates presented by Oyu Tolgoi and Turquoise Hill, a total of 1.4 billion tonnes of ore will be mined and processed through 2051. Based on these projections, the company is expected to produce 11 million tonnes of copper, 320 tonnes of gold, and 2,300 tonnes of silver. To date, 440 million tonnes of ore have already been processed and utilized.

Specifically, as of the end of 2024, 1.9 million tonnes of copper, 110 tonnes of gold, and 360 tonnes of silver have been produced and sold as concentrates. Currently, mining is concentrated solely on the Oyut open-pit. Hugo North and Hugo North Extension areas. In this context, the parties need to align their understanding, increase reserves through additional geological studies, and clearly communicate to the public that selective mining has not been carried out. The open hearing made this requirement evident.

Looking ahead, extraction may also take place at the Heruga and Hugo South deposits, which contain enormous resources of copper, gold, and silver, through the establishment of a new Investment Agreement and the implementation of a new project.

For Oyu Tolgoi LLC, creating the conditions to operate the mine safely and sustainably through significant investment is a very positive sign. At this stage, it is crucial for the shareholders - the Government of Mongolia and Rio Tinto - to negotiate and resolve the issue of returns in a mutually beneficial manner. In essence, this will serve as a 'special operation' aimed at improving Oyu Tolgoi LLC's financial position and alleviating pressures on it.

The continued rise in copper, gold, and silver prices, well beyond analysts' estimates, is undoubtedly advantageous for any country hosting a copper project and for the companies implementing it. Nevertheless, the most important objective remains in ensuring a mutually beneficial and profitable arrangement, which forms the foundation for the project's stable and sustainable operation.